Keller Williams

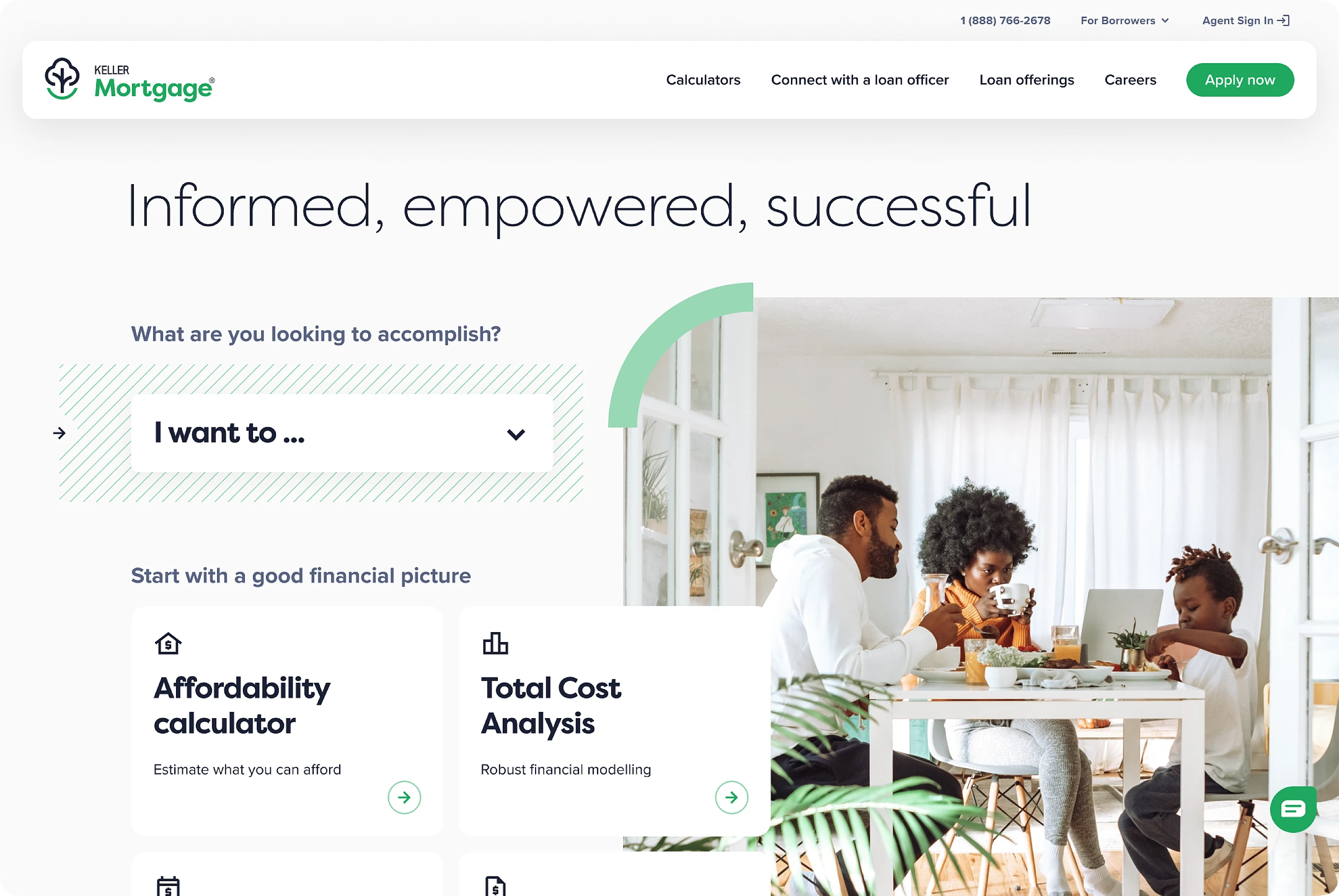

For realty-giant Keller Williams, I led a team to design a new mortgage platform, successfully disrupting a crowded market through focusing on financially empowering homebuyers.

Keller Williams is the world's largest realty company. I led a team of researchers and designers to bootstrap their new Mortgage platform from inception through launch (and subsequent sale when Keller exited the market in response to wider economic conditions). Our 'Lean Startup' process allowed us to hone in on a strategy of financial empowerment for prospective homebuyers, creating a suite of best-in-class tools and offering a 'soft-sell' approach. Crucially, we chose 'qualified leads' over merely 'leads' as our core success metric, which ensured all downstream UX work focused on building rich relationships between prospective homeowner, Loan Officer and Agent.

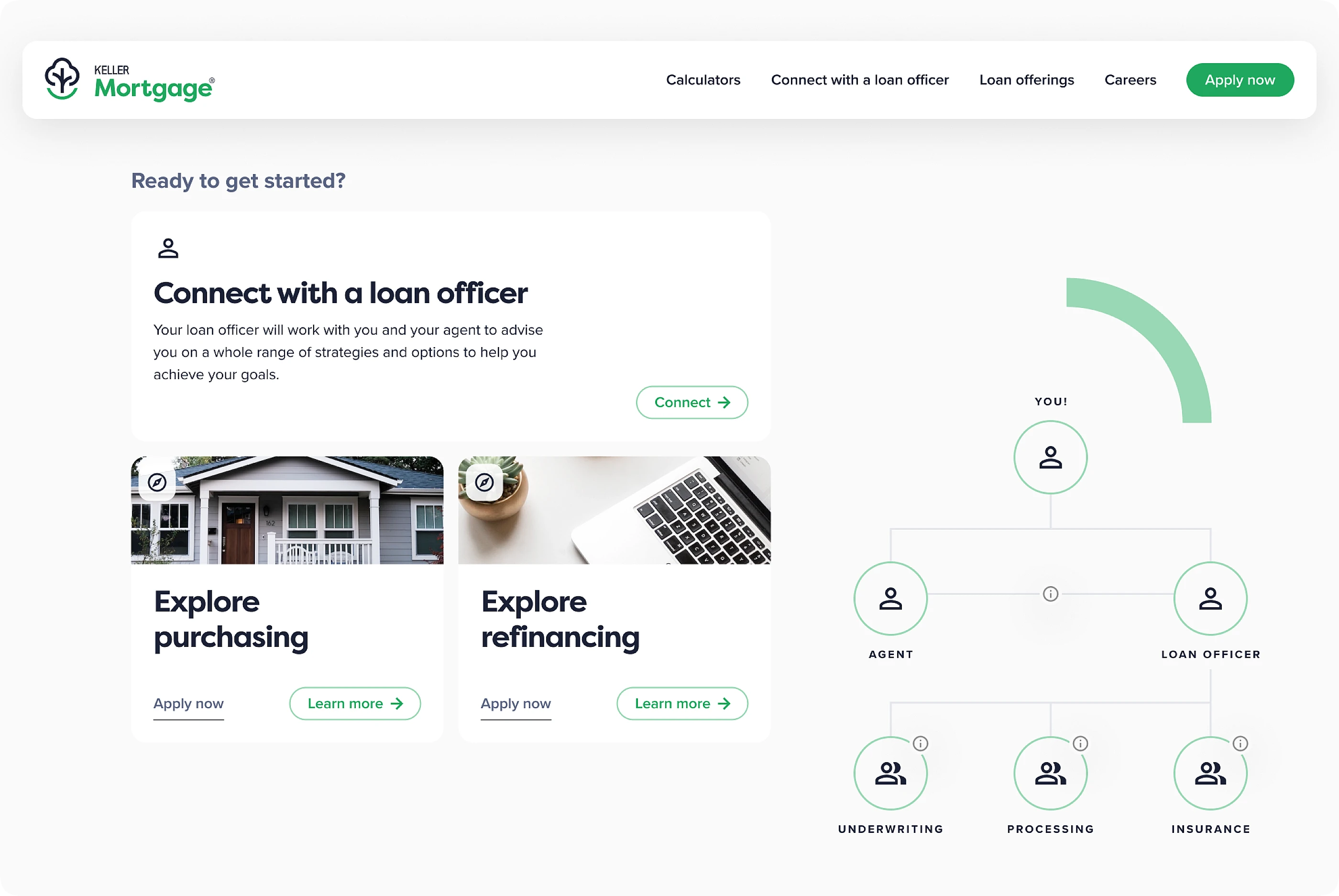

Key to our strategy was positioning the KW Loan Officer as partner with the realty agent. This allowed customers to conduct their home search in light of shared, articulated financial goals, both short and long term. Visual diagrams created a sense of transparency and approachability, helping customers understand the structure of the KW team working with them.

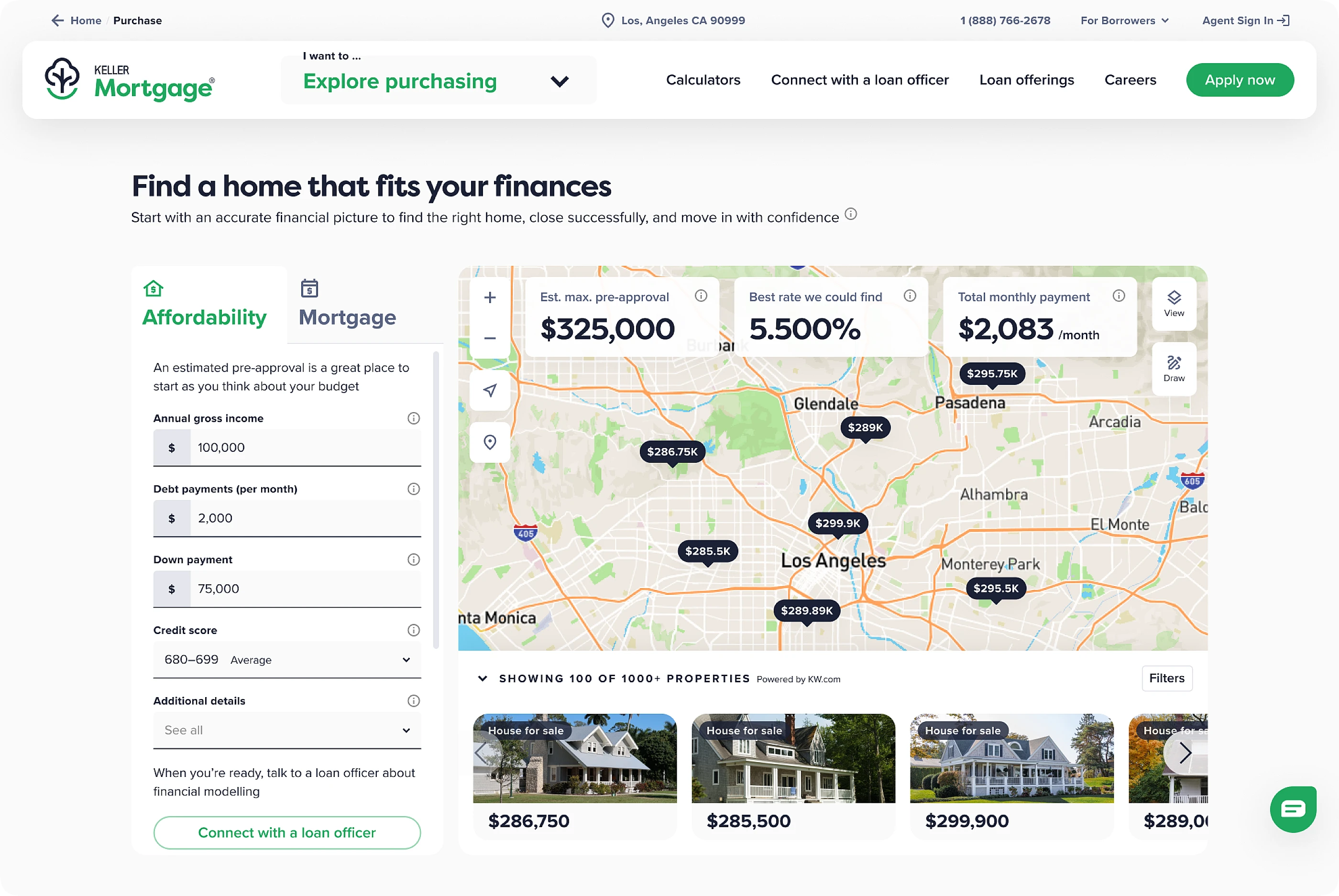

In an innovative industry-first, we designed a way to discover potential properties driven by affordability and mortgage calculators, which typically exist in isolation. This search could be captured and shared with both Loan Officer and Agent. The likelihood of successful closing was higher with these more calibrated expectations in place.

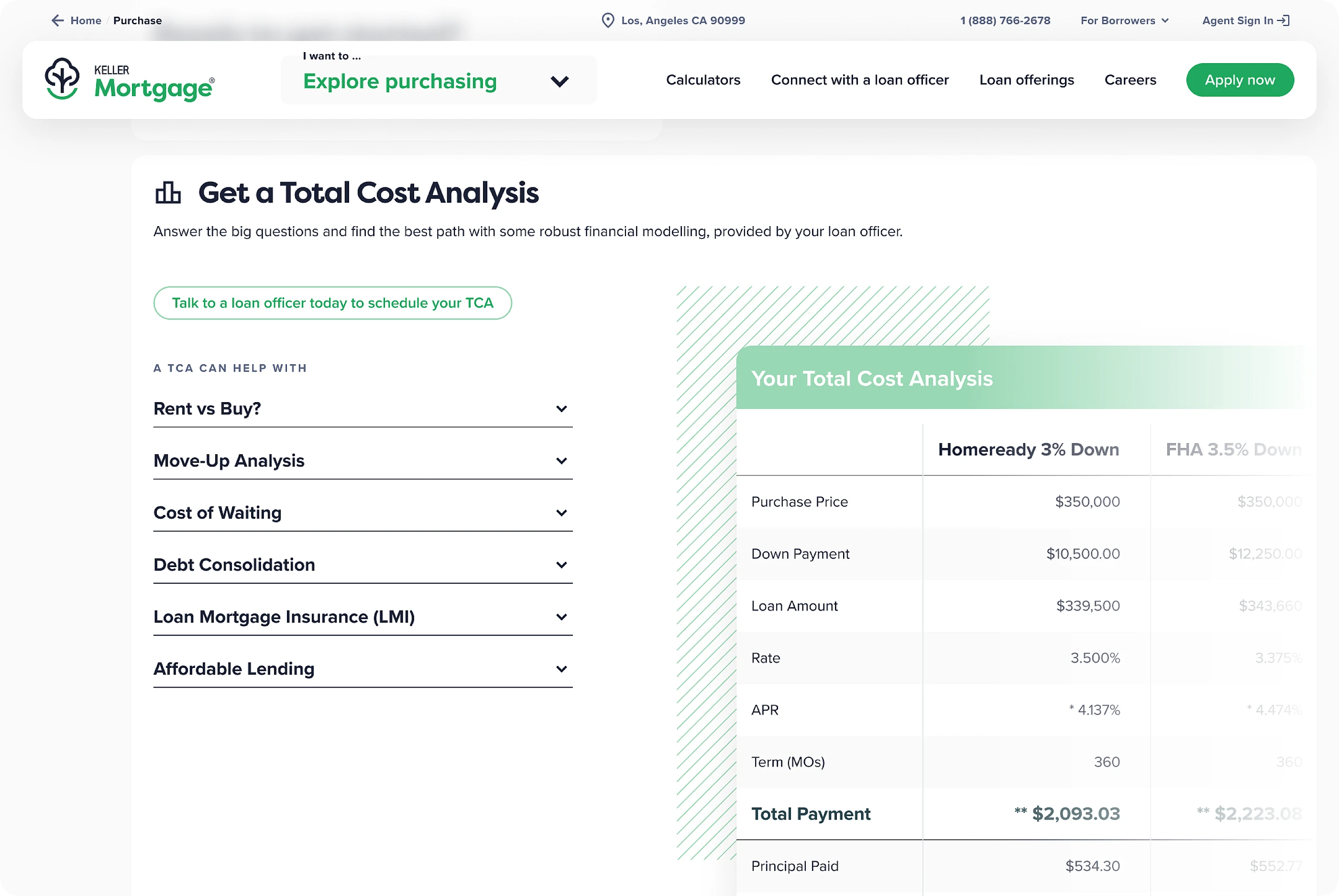

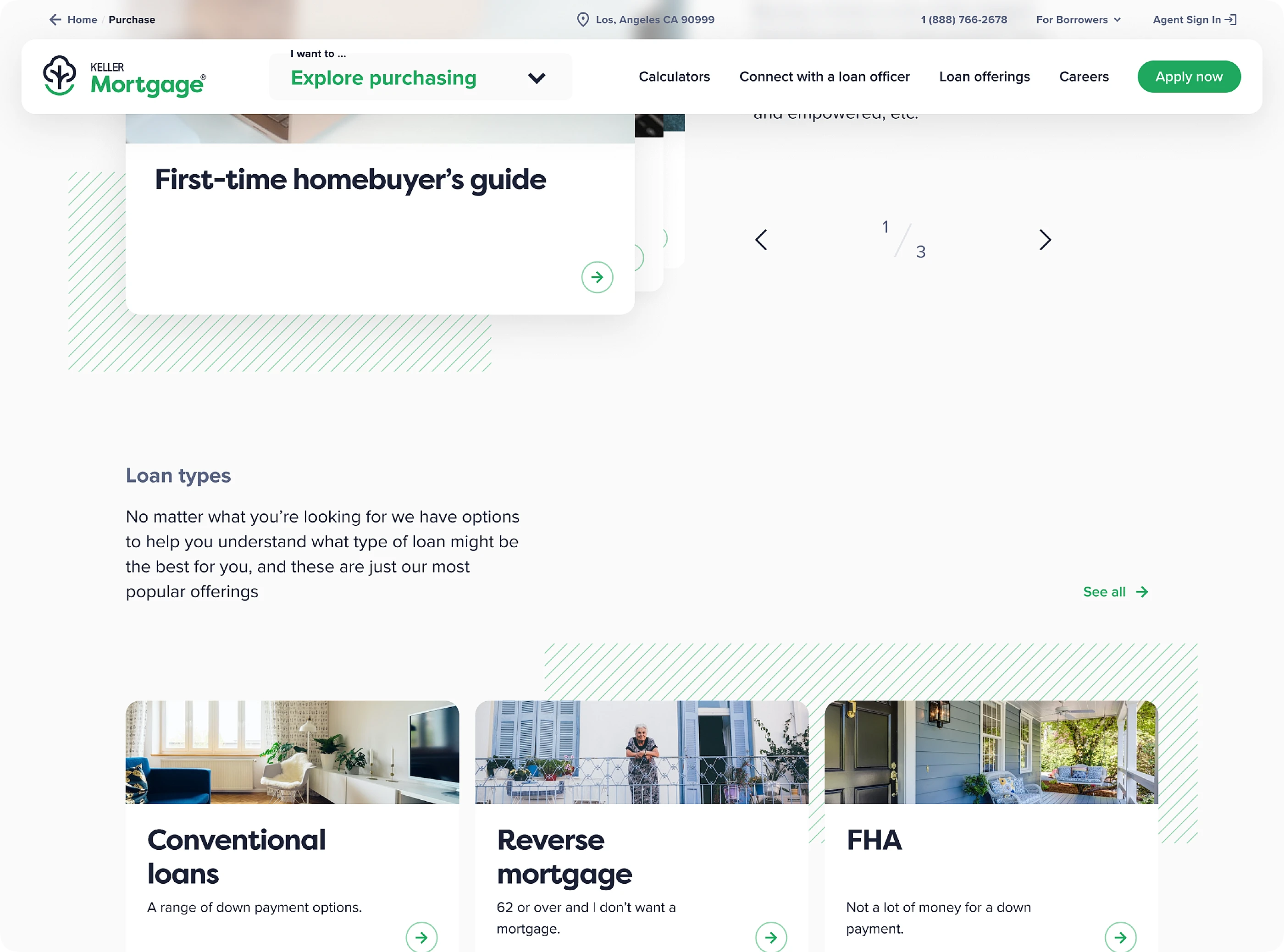

Positioning Keller Mortgage as more of a ‘suite of tools’ to help prospective homeowners, rather than taking a traditional ‘hard sell’ approach, we prominently featured a ‘Total Cost Analysis’ tool. Capturing even initial clicks into the various parameters, such as ‘Rent vs Buy?’, we were able to deepen conversations between customers and their Loan Officers and Agents.

Various UI patterns allowed for easy immersion in educational content, encouraging repeat visits and skewing towards building trust rather than pressuring the customer.

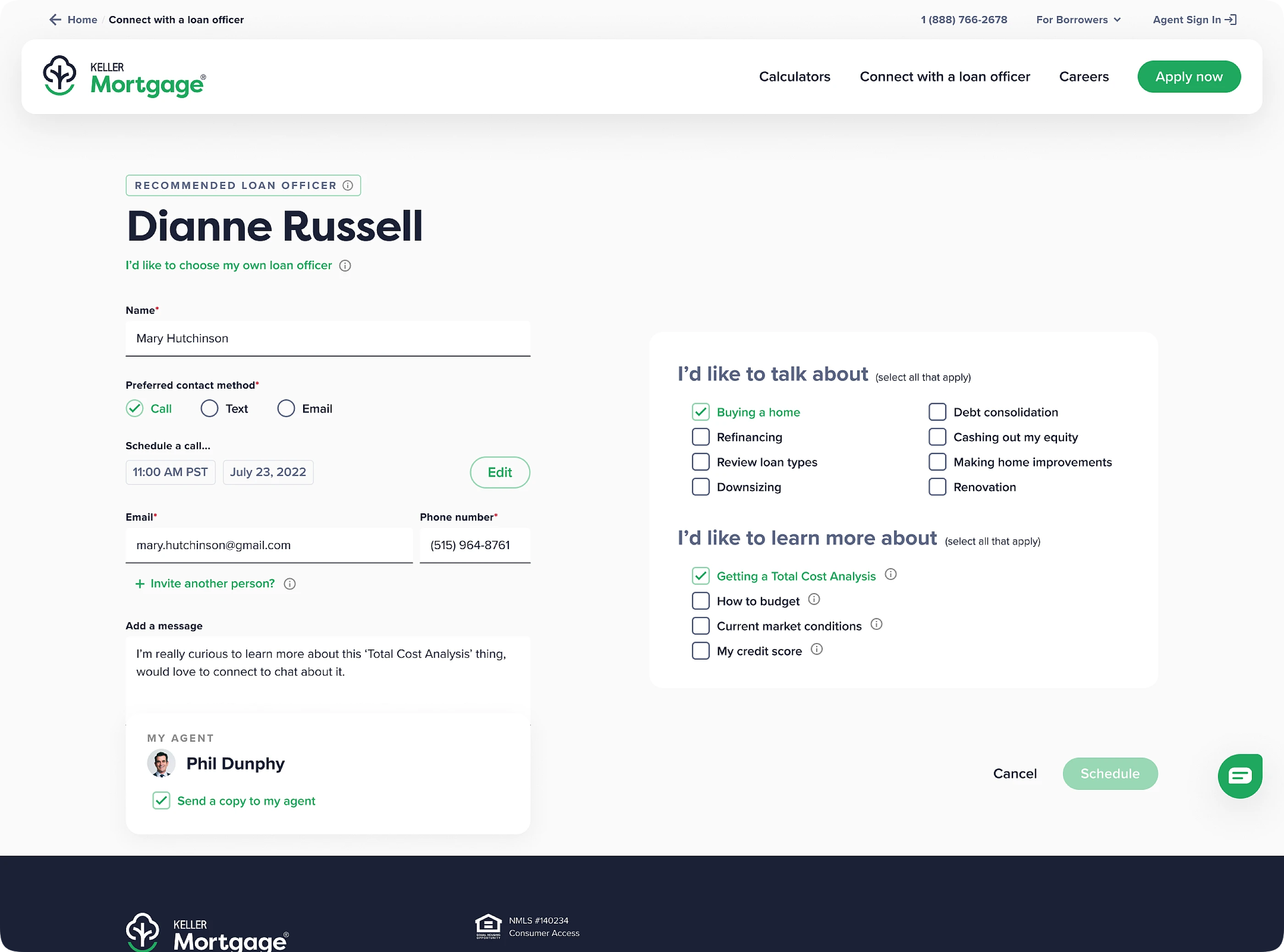

Borrowing from insights from dating apps(!), a simple contact form became an opportunity to seed the relationship between prospective homebuyer and their Loan Officer and Agent. A few checkboxes with tooltips set up a ‘call and response’ pattern of low-friction educational content, while building a rich lead record on the backend.

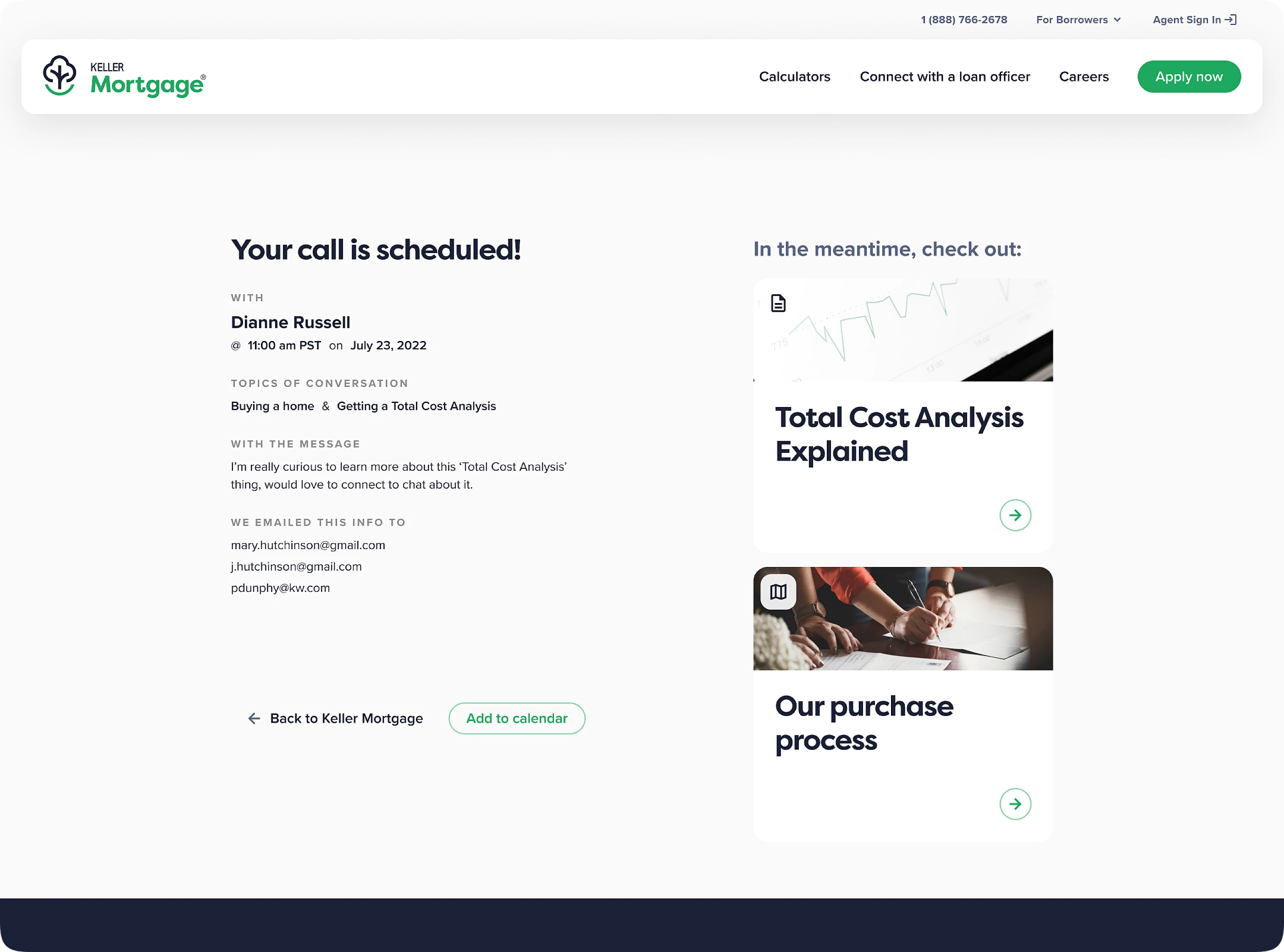

We surfaced personalized educational materials at contextually meaningful moments such as on a success screen after a customer sets up a call with their new Loan Officer.

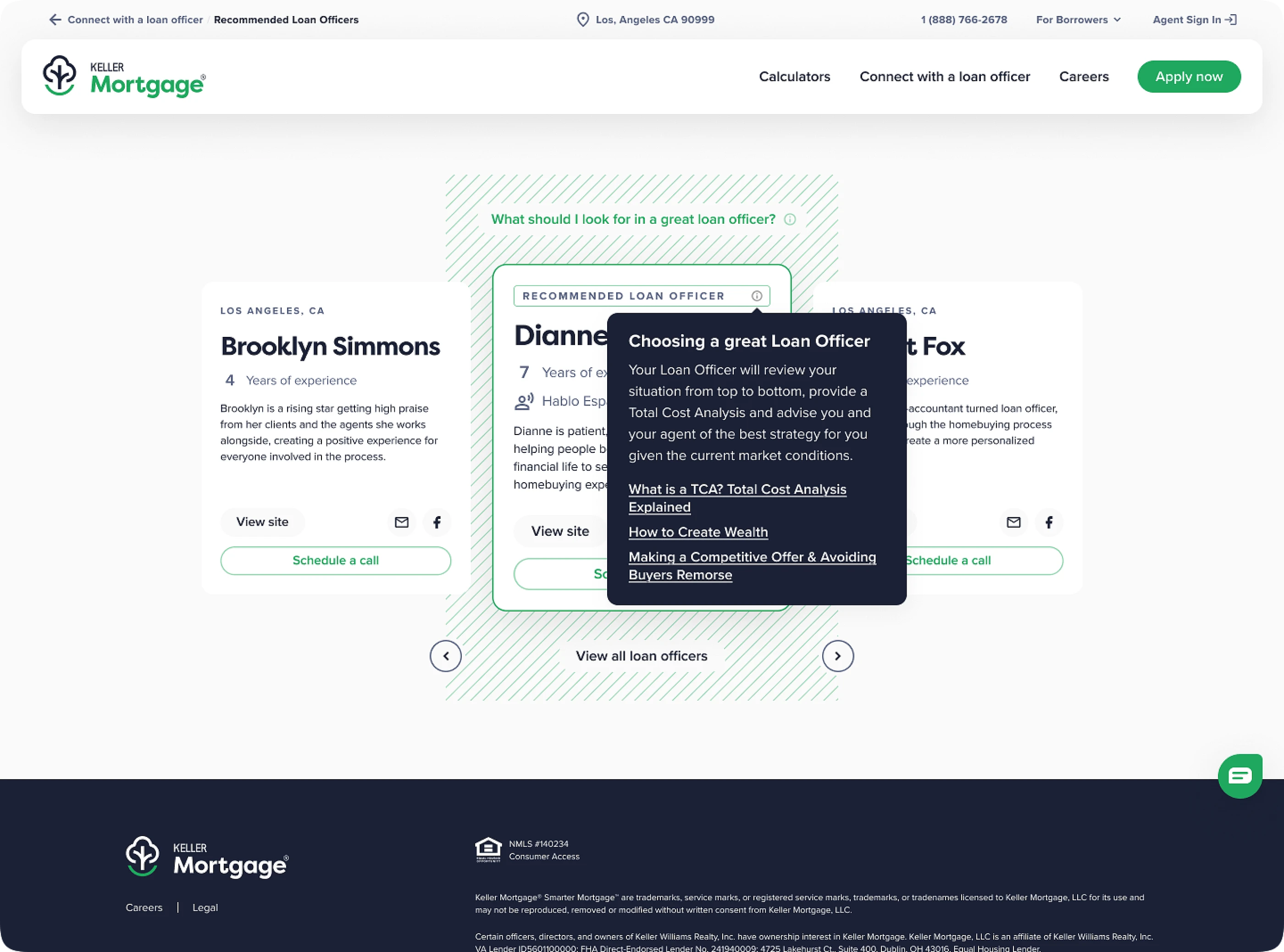

Patterns such as this helped users not only select a Loan Officer to work with, but also seeded the concept of basing their homeownership journey in the context of wider financial planning. Through multiple rounds of testing over a year and half of development, this unique strategy was validated as remarkably effective in both winning customers in a crowded market, while reducing barriers to the dream of homeownership for thousands of customers.

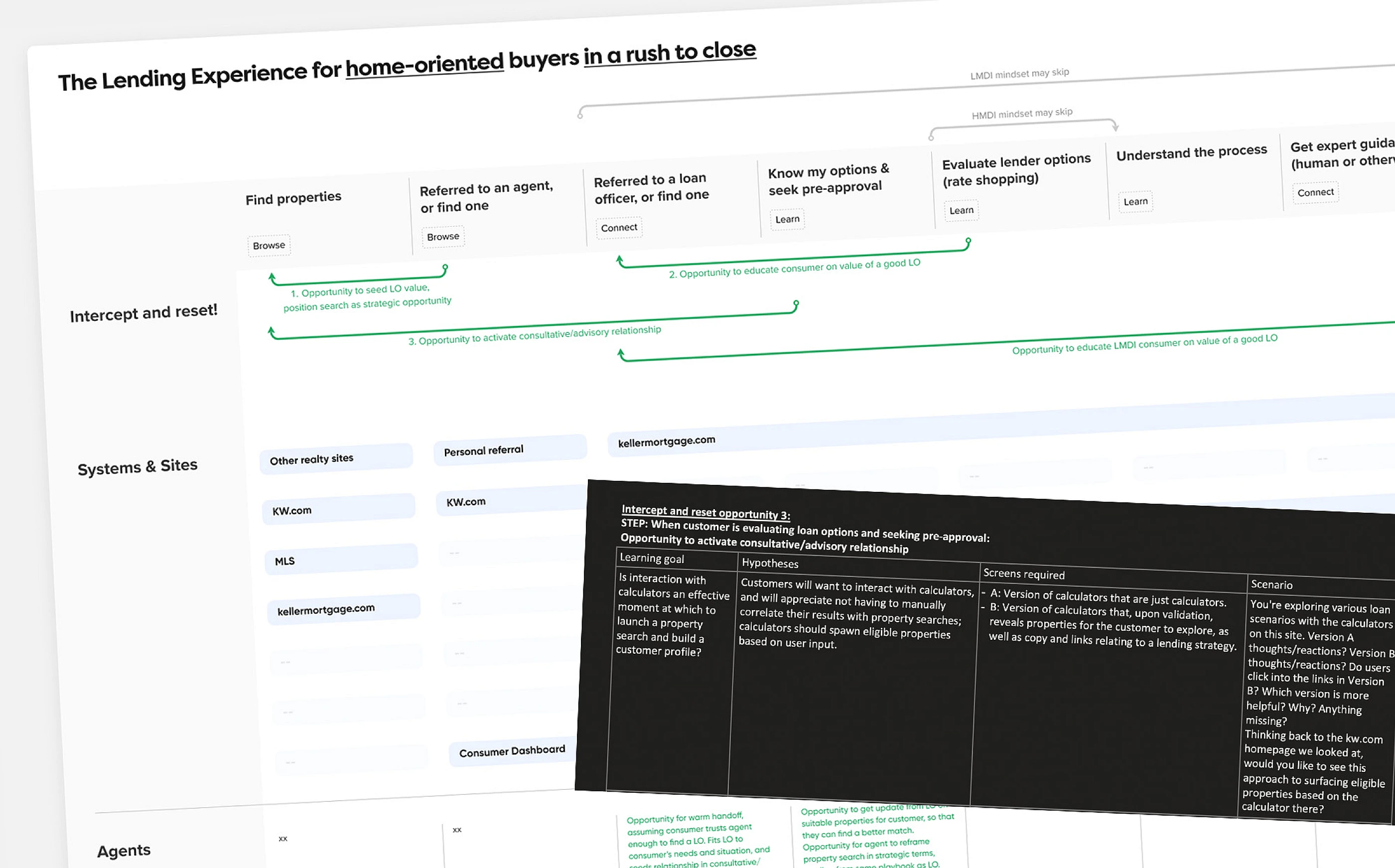

Mapping flows and buyer modalities, looking for areas to 'intercept and reset' behaviors via innovative UX.